indiana real estate taxes

2019 pay 2020 property taxes are due May 11 2020 and November 10 2020. The state does not tax Social Security benefits.

Stacy Johnson Indiana Home Living What Are Closing Costs All Settlement Or Transaction Charges That Home Buyers Need To Pay At The Close Of Escrow When The Property Is Transferred

Taxes in Indiana are due annually in 2 installments due in.

. How Property Taxes Work in Indiana. Make and view Tax Payments get current Balance Due. Besides your county and districts such as.

Real estate owners in the state of Indiana must pay taxes on their property every year. View and print Tax Statements and Comparison Reports. Property taxes have always been local governments very own domain as a funding source.

The states effective property tax rate is 11 while the national average is 107. Overall Indiana Tax Picture. Access Property Records and Imagery.

For the latest property information maps and imagery the public may access Beacons website. How to locate sales comps using Beacon. Indiana hasnt released the amount at the time of this writing but the current amount is either 60 of your propertys assessed value or a maximum of 45000 whichever is.

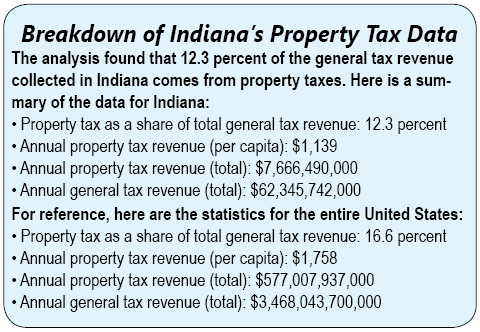

Indianas statewide average effective real estate tax rate is 087 and the average annual property tax paid in Indiana is 1100 nearly half the national average. Details on the Indiana probate and estate tax laws are outline in the table below. Homeland Security Department of.

It fully taxes withdrawals from retirement accounts. Use this application to. Taxes are due and payable in two 2 equal installments on or before May 10 and.

Welcome to the St. Criminal Justice Institute. Indiana Property Taxes Go To Different State 105100 Avg.

Indiana is moderately tax-friendly for retirees. The average national rate is. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6.

What Are Indiana Real Estate Taxes Used For. Dial these numbers in case of any emergency. There are three types of estate administration in Indiana.

Provides that for each calendar year beginning after December 31 2021 an annual adjustment of the assessed value of certain real property must. Taxes can be divided into two annual installments with one being. Tax deadline for 2020 realpersonal taxes.

In addition to Indiana state tax. Statements are mailed one time with a Spring A coupon and Fall B. The office is located in the County.

16 Oct Vigo County Treasurer. Enter your last name first initial. Property taxes in Indiana are paid in arrears meaning the taxes paid in the current year represent the taxes owed for the previous year.

Property taxes in Terre Haute Indiana are paid to the Vigo County Treasurer. Joseph County Tax research information. Property tax increase limits.

You can search the propertyproperties by. Property Reports and Tax Payments. Law Enforcement Academy Indiana.

This site is tied directly to our local assessment database and allows the public to view the latest assessor data and pay their property taxes online. State Excise Police Indiana. Various Vigo County offices coordinate the assessment and payment of property taxes.

In Indiana the average property tax bill is only 1163 per year. 085 of home value Tax amount varies by county The median property tax in Indiana is 105100 per year for a home worth the. Supervised - A personal.

Property Tax Calculator Smartasset

Indiana Property Taxes Appealing Property Tax Assessments

Property Tax Due Dates Treasurer

Cook County Il Property Tax Calculator Smartasset

How We Got Here From There A Chronology Of Indiana Property Tax Laws

City Of New Haven Tax Bills Search Pay

How Indiana S Property Taxes Compare Across Country Hamilton County Reporter

Property Taxes How Much Are They In Different States Across The Us

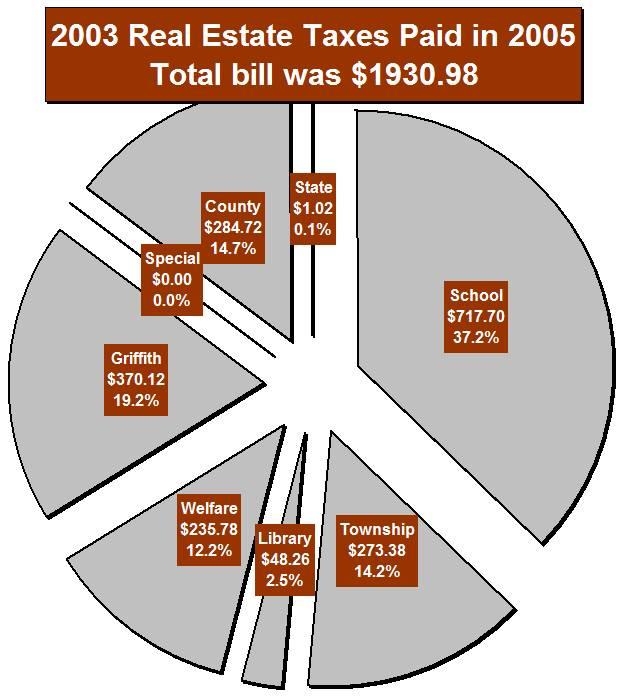

2003 Real Estate Tax Breakdown Town Of Griffith Indiana

Indiana State Taxes 2021 Income And Sales Tax Rates Bankrate

Citizen S Guide To Property Taxes

2022 Property Taxes By State Report Propertyshark

Deducting Property Taxes H R Block

The New Age In Indiana Property Tax Assessment

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Indiana Property Taxes Mainstay Basics Youtube